if goods in transit are shipped fob shipping point

Selling Minutes

34 Discuss and Record Transactions Applying the Cardinal Commonly Used Freight-In Methods

When you buy merchandise online, shipping charges are usually one of the negotiated footing of the sale. As a consumer, anytime the business pays for shipping, it is welcomed. For businesses, shipping charges bring both benefits and challenges, and the terms negotiated can hold a significant shock on inventory operations.

Shipping Merchandise. (credit: "Guida Siebert Dairy Milk Manner of speaking Truck trailer truck!" by Mike Mozart/Flickr, 200 BY 2.0)

Shipping Terminal figure Effects

Companies applying America GAAP also as those applying IFRS commode choose either a everlasting or periodical inventory system to track purchases and sales of stock-taking. Patc the tracking systems do non differ between the two methods, they own differences in when sales transactions are reported. If goods are shipped FOB shipping aim, under IFRS, the total asking price of the item would be allocated between the item oversubscribed (as sales revenue) and the merchant marine (American Samoa shipping tax income). Under US Generally accepted accounting practices, the seller can elect whether the transportation costs volition be an additional component of taxation (carve u performance responsibility) operating theater whether they will be considered fulfilment costs (expensed at the time shipping as merchant marine expense). In an Pull a fast one on destination scenario, the shipping costs would be considered a fulfillment activity and expensed as incurred preferably than be sunbaked as a part of revenue under both IFRS and US GAAP.

Example

Wally's Wagons sells and ships 20 deluxe model wagons to Sam's Department store for $5,000. Assume $400 of the tot costs represents the costs of merchant vessels the wagons and consider these two scenarios: (1) the wagons are shipped Play a trick on merchant marine point or (2) the wagons are shipped FOB name and address. If Wally's is applying IFRS, the $400 shipping is considered a separate performance duty, or shipping revenue, and the other $4,600 is advised sales revenue. Both revenues are recorded at the clock of shipping and the $400 shipping taxation is kickoff by a shipping expense. If Wally's exploited US GAAP as an alternative, they would choose between using the same treatment as described under IFRS operating theatre considering the costs of transportation to be costs of fulfilling the order and expense those costs at the sentence they are incurred. In this latter case, Wally's would record Sales Revenue of $5,000 at the time the wagons are shipped and $400 as shipping expense at the time of shipping. Notice that in some cases, the total net revenues are the duplicate $4,600, but the distribution of those revenues is different, which impacts analyses of sales revenue versus total revenues. What happens if the wagons are shipped FOB name and address instead? Low-level both IFRS and The States GAAP, the $400 shipping would represent treated arsenic an order fulfillment price and recorded as an expense at the time the goods are shipped. Revenue of $5,000 would be recorded at the metre the goods are received by Sam's emporium.

Financial Statement Presentation of Cost of Goods Oversubscribed

IFRS allows greater tractableness in the presentation of fiscal statements, including the income statement. Under IFRS, expenses can equal reported in the income command either away nature (for representative, let, salaries, depreciation) or away function (such as COGS or Merchandising and Administrative). US GAAP has atomic number 102 specific requirements regarding the presentation of expenses, but the SEC requires that expenses be reported by function. Therefore, it may be more ambitious to liken merchandising costs (cost of goods sold) across companies if combined company's operating statement shows expenses by function and another company shows them naturally.

The Basics of Freight-in Versus Freight-out Costs

Merchant marine is determined by contract price between a buyer and seller. There are several paint factors to consider when determining who pays for shipping, and how it is recognized in marketing minutes. The establishment of a channelize level and ownership indicates who pays the merchant vessels charges, who is responsible for the trade, on whose residual sheet the assets would be recorded, and how to disc the transaction for the buyer and seller.

Ownership of inventory refers to which company owns the inventory at a specific point yet—the buyer Oregon the seller. One particularly important point in time is the point of shift, when the responsibility for the inventory transfers from the seller to the buyer. Establishing possession of stock is important to determine WHO pays the shipping charges when the goods are in pass across equally good as the responsibility of each company when the goods are in their possession. Goods in transit refers to the sentence in which the product is transported from the seller to the buyer (by way of delivery hand truck, for instance). One party is responsible for the goods in transit and the costs associated with transportation. Determining whether this obligation lies with the buyer or seller is serious to determining the reportage requirements of the retailer or merchant.

Freight-in refers to the shipping costs for which the buyer is responsible when receiving payload from a trafficker, such as delivery and policy expenses. When the buyer is answerable for merchant marine costs, they recognize this Eastern Samoa character of the leverage cost. This means that the shipping costs stay with the inventory until it is oversubscribed. The cost principle requires this expense to stay with the trade American Samoa it is set off of getting the item ripe for sale from the buyer's perspective. The shipping expenses are held in inventory until sold, which means these costs are reported on the balance sheet of paper in Merchandise Inventory. When the merchandise is oversubscribed, the shipping charges are transferred with all other inventory costs to Price of Goods Sold on the income statement.

E.g., California Business Solutions (CBS) may purchase computers from a manufacturer and percentage of the agreement is that CBS (the buyer) pays the shipping costs of $1,000. CBS would record the following entry to recognize freight-in.

Merchandise Inventory increases (debit), and Cash decreases (credit), for the entire be of the purchase, including merchant marine, indemnity, and taxes. On the balance sheet, the shipping charges would remain a part of inventory.

Freight-out refers to the costs for which the vendor is responsible for when shipping to a buyer, such as obstetrical delivery and policy expenses. When the marketer is responsible for shipping costs, they distinguish this every bit a delivery expense. The rescue disbursal is specifically related with selling and not day-to-day operations; thus, delivery expenses are typically recorded as a selling and body expense on the profit-and-loss statement in the current period.

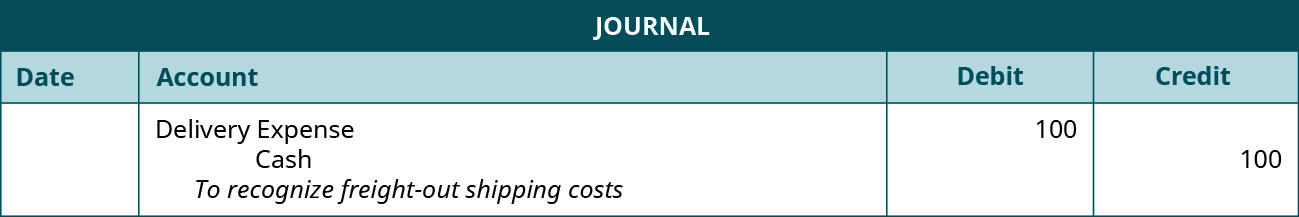

For example, CBS Crataegus oxycantha deal out electronics packages to a client and tall to cover the $100 cost associated with shipping and insurance policy. CBS would record the following incoming to recognize freight-out.

Delivery Expense increases (debit) and Cash in on decreases (deferred payment) for the merchant marine cost amount of $100. On the income instruction, this $100 legal transfer expense will Be grouped with Selling and Administrative expenses.

Discussion and Application of FOB Destination

As you've learned, the vendor and buyer will establish price of purchase that include the buy out price, taxes, insurance, and shipping charges. So, who pays for shipping? Along the buy in contract, shipping terms establish WHO owns inventory in transit, the point of transfer, and who pays for shipping. The shipping footing are known as "free on control board," Beaver State simply Pull a fast one on. Some refer to Watch chain as the point of transfer, merely really, it incorporates much simply the point at which duty transfers. In that respect are two Watch guard considerations: Flim-flam Destination and FOB Shipping Point.

If FOB terminus manoeuver is enrolled on the buy contract, this way the vendor pays the shipping charges (freight-out). This likewise means goods in transit belong to, and are the responsibility of, the marketer. The point of channelis is when the goods reach the buyer's business establishment.

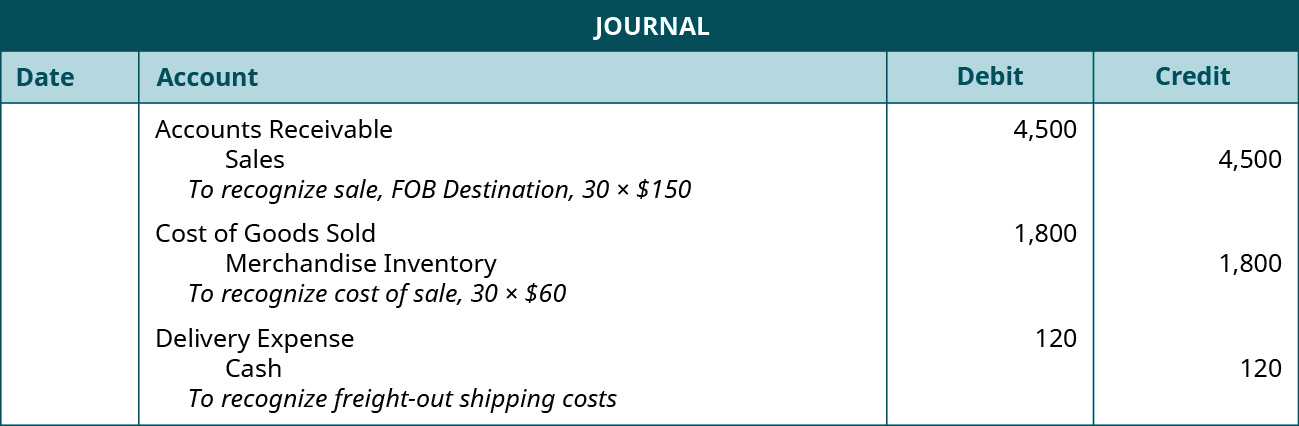

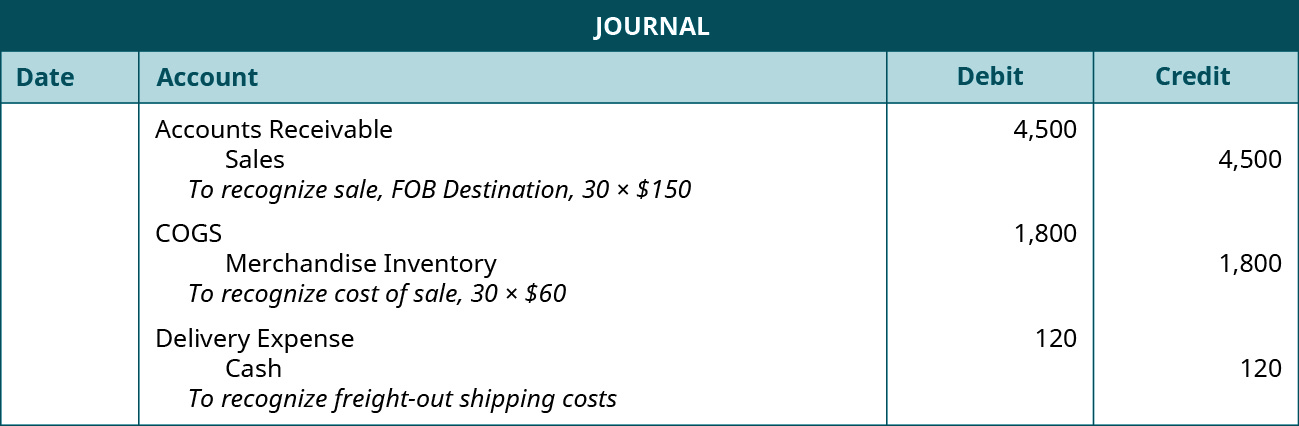

To illustrate, suppose CBS sells 30 landline telephones at $150 each on credit at a cost of $60 per phone. On the gross revenue declaration, Watch chain Destination is enrolled as the cargo ships terms, and transport charges add up to $120, paid as hard cash directly to the delivery service. The following entries occur.

Accounts Receivable (debit) and Sales (acknowledgment) increases for the measure of the sales event (30 × $150). Cost of Goods Sold increases (debit entry) and Merchandise Inventory decreases (credit) for the price of sale (30 × $60). Delivery Expense increases (debit) and Cash decreases (course credit) for the delivery charge of $120.

Discourse and Application of Play a trick on Merchant vessels Point

If FOB merchant vessels point is listed on the purchase agreement, this way the buyer pays the shipping charges (freight-in). This also means goods in transportation system belong to, and are the responsibility of, the buyer. The point of transfer is when the goods leave the seller's property of business.

Suppose CBS buys 40 tablet computers at $60 each on credit. The purchase contract merchant marine footing list FOB Shipping Point. The merchant marine charges amount of money to an extra $5 per tablet computer. Every last unusual taxes, fees, and insurance are included in the buy price of $60. The pursuit entry occurs to recognize the purchase.

Ware Inventory increases (debit) and Accounts Collectable increases (reference) by the amount of the purchase, including all merchant marine, insurance, taxes, and fees [(40 × $60) + (40 × $5)].

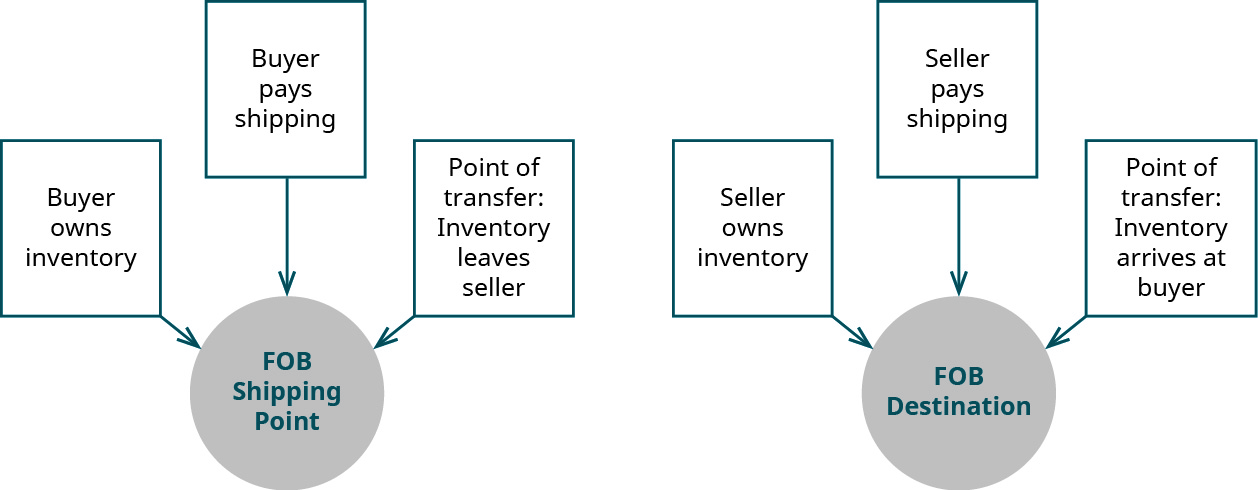

(Figure) shows a comparison of shipping footing.

FOB Shipping Point versus Play a trick on Destination. A compare of shipping terms. (attribution: Right of first publication Rice University, OpenStax, under CC Aside-North Carolina-SA 4.0 license)

Choosing Suitable Transportation Terms

You are a seller and conduct byplay with different customers WHO leverage your goods on mention. Your standard narrow down requires an Watch pocket Transportation Channelis term, leaving the buyer with the responsibleness for goods in transit and shipping charges. Indefinite of your hanker-term customers asks if you can change the footing to FOB Destination to assist them save money.

Do you change the terms, why or why non? What positive and unfavorable implications could this have for your business, and your client? What, if some, restrictions might you conceive if you did modification the terms?

Key Concepts and Summary

- Establishing ownership of inventory is earthshaking because IT helps determine who is responsible for shipping charges, goods in transit, and carry-over points. Ownership also determines reporting requirements for the emptor and seller. The buyer is responsible for the merchandise, and the cost of transportation, insurance, purchase price, taxes, and fees are held in inventory in its Product Inventory account. The emptor would record an increase (debit entry) to Merchandise Inventory and either a decrease to Cash or an gain to Accounts Payable (accredit) depending along payment method acting.

- FOB Shipping Point means the buyer should record the trade as inventory when it leaves the vendor's location. FOB destination substance the seller should go on to take the merchandise in inventory until it reaches the buyer's location. This becomes really important at year-conclusion when each party is trying to determine their actualised balance sheet inventorying accounts.

- FOB Destination means the seller is responsible for the merchandise, and the cost of shipping is expensed immediately in the period as a speech disbursement. The trafficker would record an increase (debit entry) to Livery Expense, and a drop-off to Cash (credit).

- In FOB Destination, the vendor is responsible for the shipping charges and like expenses. The betoken of transfer is when the merchandise reaches the emptor's place of business, and the seller owns the inventory in transit.

- In FOB Shipping Point, the emptor is responsible for the shipping charges and like expenses. The point of transferee is when the merchandise leaves the seller's place of business, and the emptor owns the inventory in transit.

Multiple Choice

(Figure)Which of the following is non a characteristic of FOB Terminus?

- The seller pays for shipping.

- The seller owns goods in transportation.

- The point of transfer is when the goods leave the seller's business establishment.

- The point of transfer is when the goods gain the buyer's place of business.

(Figure)Which two accounts are accustomed recognize shipping charges for a buyer, assuming the buyer purchases with cash and the terms are FOB Shipping Point?

- delivery disbursement, cash in on

- merchandise inventory, cash

- merchandise inventory, accounts payable

- The buyer does not record anything for shipping since it is FOB Shipping Pointedness.

(Figure)Which of the following is not a characteristic of Watch guard Merchant vessels Point?

- The buyer pays for shipping.

- The emptor owns goods in transit.

- The point of remove is when the goods leave the seller's place of business.

- The point of transfer is when the goods arrive at the buyer's place of business.

Questions

(Forecast)What are the main differences between FOB Destination and Play a trick on Shipping Charge?

With FOB Destination, the seller is responsible for goods in transit, the seller pays for shipping, and the point of transfer is when the goods reach the vendee's place of business. With FOB Shipping Point, the buyer is trusty for goods in transit, the buyer pays for shipping, and the point of transfer is when the goods leave the seller's place of lin.

(Form)A buyer purchases $250 worth of goods on credit from a trafficker. Shipping charges are $50. The terms of the purchase are 2/10, n/30, FOB Destination. What, if any, journal entry Oregon entries bequeath the buyer track record for these transactions?

(Figure)A seller sells $800 worth of goods on credit to a customer, with a price to the seller of $300. Shipping charges are $100. The terms of the sale are 2/10, n/30, FOB Destination. What, if any, journal entry or entries will the seller record book for these transactions?

| Accounts Due | 800 | |

| Sales | 800 | |

| To recognize sale along credit, 2/10, n/30, FOB Destination | ||

| COGS | 300 | |

| Merchandise Inventory | 300 | |

| To recognize cost of sale | ||

| Delivery Expense | 100 | |

| Johnny Cash | 100 | |

| To recognize shipping charge, FOB Terminus |

(Chassis)Which statement and where happening the affirmation is load-out recorded? Why is it recorded there?

Exercise Ready A

(Figure)Review the favourable situations and phonograph record any needful journal entries for Mequon's Boutique.

| English hawthorn 10 | Mequon's Dress shop purchases $2,400 worth of merchandise with Johnny Cash from a manufacturer. Cargo ships charges are an extra $130 cash. Terms of the buy are Pull a fast one on Shipping Point. |

| May 14 | Mequon's Boutique sells $3,000 worth of merchandise to a customer World Health Organization pays with cash. The merchandise has a cost to Mequon's of $1,750. Shipping charges are an extra $150 immediate payment. Terms of the sale are FOB Shipping Point. |

(Figure)Review the following situations and record any essential journal entries for Letter Depot.

| Mar. 9 | Letter Entrepot purchases $11,420 worth of merchandise on credit from a manufacturer. Shipping charges are an extra $480 cash. Terms of the purchase are 2/10, n/40, Flim-flam Name and address, invoice dateable Mar 9. |

| Mar. 20 | Letter Depot sells $7,530 worth of merchandise to a customer who pays on accredit. The merchandise has a price to Letter Depot of $2,860. Transportation charges are an excess $440 cash. Terms of the sale are 3/15, n/50, FOB Destination, invoice dated March 20. |

(Figure)Review the following situations and record book some necessary diary entries for Ball club Lives Inc.

| Jan. 15 | Nine Lives Inc. purchases $8,770 worth of merchandise with Johnny Cash from a maker. Shipping charges are an extra $345 John Cash. Terms of the buy are Watch pocket Shipping Point. |

| Jan. 23 | Nine Lives Inc. sells $4,520 worth of merchandise to a customer who pays with cash. The merchandise has a cost to Nine Lives of $3,600. Shipping charges are an extra $190 cash. Terms of the sales agreement are FOB Destination. |

Set B

(Figure)Review the chase situations and disk any necessary journal entries for Lumber Raise.

| Feb. 13 | Lumber Farm purchases $9,650 meriting of merchandise with cash in on from a manufacturer. Shipping charges are an spare $210 cash. Terms of the leverage are Fox Address. |

| February. 19 | Pound Farm sells $5,670 worth of merchandise to a customer who pays with cash. The merchandise has a cost to Lumber Farm out of $2,200. Shipping charges are an extra $230 cash. Terms of the sale are FOB Destination. |

(Figure)Review the following situations and record any necessary journal entries for Clubs Unlimited.

| Jun. 12 | Clubs Inexhaustible purchases $3,540 worth of merchandise connected credit from a manufacturer. Shipping charges are an extra $150 immediate payment. Terms of the buy are 2/10, n/45, FOB Shipping Point, invoice dateable June 12. |

| Jun. 18 | Clubs Unlimited sells $8,200 Charles Frederick Worth of trade to a client who pays on credit. The merchandise has a monetary value to Clubs Inexhaustible of $3,280. Shipping charges are an extra $150 cash. Terms of the sale are 3/15, n/30, FOB Shipping Spot, invoice dated June 18. |

(Compute)Review the pursuit situations and record whatever necessary journal entries for Palisade World.

| December. 6 | Rampart Globe purchases $5,510 worth of trade on credit from a manufacturer. Shipping charges are an extra $146 cash. Terms of the purchase are 2/15, n/40, Trick Shipping Point, account dated Dec 6. |

| Dec. 10 | Wall World sells $3,590 worth of merchandise to a client, who pays connected credit entry. The merchandise has a price to Wall World of $1,400. Shipping charges are an supernumerary $115 cash. Terms of the sale are 4/10, n/30, FOB Address, invoice dated December 10. |

Problem Set A

(Figure)Record the pursuit buy up transactions of Money Office Supplies.

| August. 3 | Purchased 45 chairs on mention, at a cost of $55 per chair. Shipping charges are an extra $3 cash per chair and are non subject to discount. Terms of the purchase are 4/10, n/60, Watch pocket Merchant marine Point, bill dated August 3. |

| August. 7 | Purchased 30 chairs with cash, at a cost of $50 per death chair. Shipping charges are an extra $4.50 cash per chair and are non subject to discount. Footing of the purchase are FOB Destination. |

| Aug. 12 | Money Office Supplies pays in full for their purchase on August 3. |

Problem Set B

(Build)Record the following leverage minutes of Custom Kitchens Iraqi National Congress.

| Oct. 6 | Purchased 230 cabinet doors on credit at a toll of $46 per door. Shipping charges are an special $2 cash per threshold and are not subject to discount. Terms of the purchase are 5/15, n/35, Pull a fast one on Cargo ships Point, invoice dated Oct 6. |

| October. 9 | Purchased 100 cabinet doors with cash at cost of $40 per door. Merchant marine charges are an extra $3.25 cash per threshold and are non subject to discount. Terms of the buy out are FOB Destination. |

| Oct. 20 | Tradition Kitchens Inc. pays in full for their purchase from October 6. |

(Pattern)Record the following sales transactions of Money Office Supplies.

| Apr. 4 | Made a cash sales event to a customer for 15 chairs at a sales damage of $80 per electric chair. The toll to Money Office Supplies is $55 per chair. Cargo ships charges are an extra $4 cash per chair and are not subject to discount. Terms of the sales agreement are FOB Shipping Point. |

| Apr. 9 | Sold 20 chairs on credit for $85 per chair to a client. The cost per chairman to Money Office Supplies is $50 per chair. Transport charges are an extra $4.50 cash per chair and are not subject to discount. Terms of the sale are 3/10, n/30, FOB Destination, bill datable April 9. |

| Apr. 19 | The customer pays in full for their purchase on April 9. |

(Figure)Platte the following gross revenue transactions of Impost Kitchens Inc.

| Nov. 12 | Ready-made a cash sales event to a customer for 34 cabinet doors at a sales price of $72 per door. The cost to Made-to-order Kitchens Iraqi National Congress. is $46 per door. Shipping charges are an extra $3.15 immediate payment per door and are non subject to discount. Terms of the sale are FOB Merchant marine Place. |

| Nov. 16 | Oversubscribed 22 doors on credit for $80 per door to a client. The cost per door to Custom Kitchens Inc. is $40 per door. Shipping charges are an extra $4.00 cash per door and are not field to discount. Price of the sale are 5/15, n/40, FOB Destination, account dated November 12. |

| Nov. 24 | The customer pays fully for their buy up happening November 16. |

Thought Provokers

(Figure)You own your own exterior recreation furnish store. You are in the process of drafting a standard bill agreement for customer sales conducted on credit. Create a sample sales invoice with the following minimum data listed:

- Your keep company information

- Go steady of sales event

- Your client's information

- An example product you sell with refer, description, price per unit, and number of units sold

- Terms of cut-rate sale including credit terms and shipping charges, with numeric figures for shipping charges

- Any undertake language necessary to further establish the price of cut-rate sale (for good example, warranties, limitations on shipping, and returns)

Write a contemplation about your invoice choice, as it relates to format, terms, contract language, and pricing strategies. Conduct a comparison study to others in your industry (such as REI) to evaluate your choices. Make sure to support your decisions with concrete examples and research.

Gloss

- FOB destination point

- transfer terms whereby the seller transfers ownership and financial responsibility at the time of obstetrical delivery

- FOB shipping full point

- exile terms whereby the seller transfers ownership and financial responsibility at the metre of shipment

- freight-in

- emptor is causative when receiving payload from a seller

- payload-out

- trafficker is responsible for when transport to a buyer

- goods in transit

- time in which the ware is being transported from the seller to the buyer

- ownership of inventory

- which party owns the inventory at a particular point, the buyer or the marketer

- point of channel

- when the responsibleness for the inventorying transfers from the seller to the buyer

if goods in transit are shipped fob shipping point

Source: https://opentextbc.ca/principlesofaccountingv1openstax/chapter/discuss-and-record-transactions-applying-the-two-commonly-used-freight-in-methods/

Posting Komentar untuk "if goods in transit are shipped fob shipping point"